mindox team participated in the World Financial Innovation Series 2024 – Philippines

The WFIS 2024 – Philippines event has come to a close, marking another successful gathering of the brightest minds and most innovative companies in the financial sector. Over the course of two days, the event featured a series of keynote presentations, booth-side chats, and panel discussions, all designed to explore the latest trends and challenges […]

AND Solutions Partners with Esquire Financing Inc. to Enhance Financial Operations with MINDOX in the Philippines

AND Solutions Partners with Esquire Financing Inc. to Enhance Financial Services with Intelligent Document Processing and Credit Scoring Solutions in the Philippines PHILIPPINES: Leading fintech company AND Global’s subsidiary, AND Solutions, has today announced a new partnership with Esquire Financing Inc., a Philippines-based non-bank financial institution that specializes in providing business loans to SMEs. The […]

Successfully Implementing IT Solutions: A Comprehensive Guide to SaaS and PaaS

This guide equips you with the knowledge and steps to successfully integrate Software as a Service (SaaS) and Platform as a Service (PaaS) solutions into your business. By following these steps strategically, you can unlock significant improvements in efficiency, scalability, and innovation. Getting Ready for Success Before diving into implementation, consider these important factors: Change […]

How AI can revolutionize banking and boost financial inclusion.

Just a few years ago, generative AI was a mere buzzword. Then came ChatGPT in 2022, and suddenly, this novel concept became an undeniable force reshaping our world. This AI revolution, powered by sophisticated large language models, has ignited a global technological race. From established corporations to nimble startups and visionary researchers, everyone’s vying for […]

Reimagining Financial Inclusion in Southeast Asia: Challenges and Solutions

Southeast Asia’s fintech landscape is brimming with potential, but a large portion of the population remains excluded from essential financial services. Limited access to formal banking, heavy reliance on cash transactions, and inadequate digital infrastructure create significant roadblocks. Overly stringent regulations can also stifle innovation and make it difficult for startups to offer affordable and […]

Future-Proof Your Business: The Indispensable Role of Technological Solutions in 2024

Introduction: As 2024 unfolds, the business world finds itself at a pivotal juncture, heavily influenced by rapid technological advancements. In this era, digital transformation is no longer a choice but an urgent necessity. It’s essential for businesses to understand how technology has become the backbone of efficiency, innovation, and maintaining a competitive edge. This transformation […]

Elevating Loan Origination and Management in 2024

Introduction: In 2024, the financial landscape continues to shift dramatically, making loan origination and management systems increasingly vital. These aren’t just tools; they represent a significant leap forward in how financial institutions process, approve, and oversee loans. This blog will explore the critical role and benefits of these advanced systems, which stand at the forefront […]

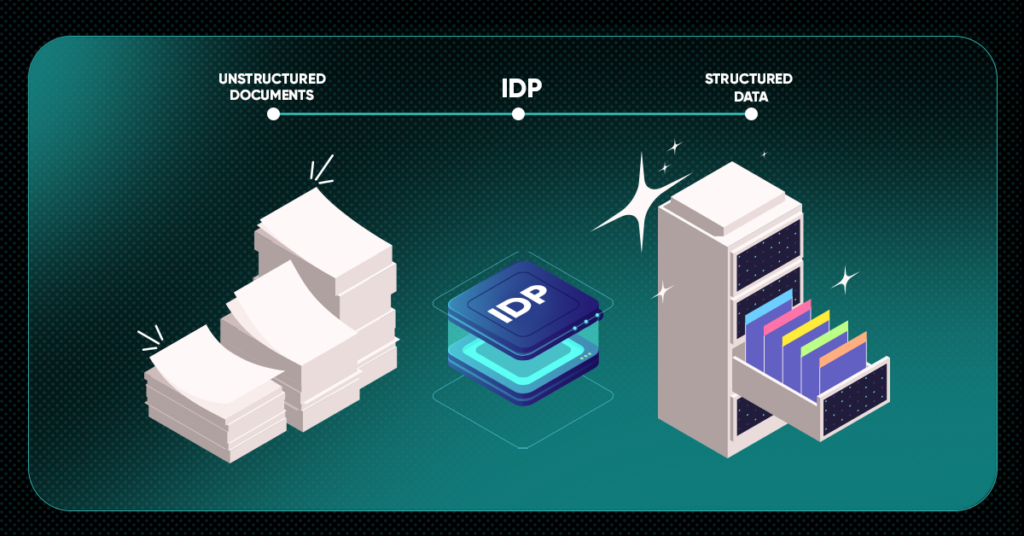

Say Goodbye to Manual Document Handling: Embrace Intelligent Processing in 2024

As we navigate through 2024, the relevance and impact of Intelligent Document Processing (IDP) in the business world continue to grow. This blog post aims to explore how IDP, with its blend of AI, machine learning, and natural language processing, is revolutionizing the way businesses handle and process vast amounts of data. We’ll delve into […]

How Can Financial Institutions Reap the Benefits of Implementing a Credit Scoring System in 2024?

What are Credit Scoring Systems? Credit scoring systems are mechanisms used by financial institutions to evaluate the creditworthiness of potential borrowers. These systems, increasingly powered by AI and machine learning, analyze a wide array of data to predict the likelihood of a borrower repaying a loan. This technological evolution has significantly enhanced the accuracy and […]

AI Regulation and Innovation: Navigating Southeast Asia’s Tech Landscape in the ChatGPT Era

In recent years, Generative Artificial Intelligence (AI) has captured widespread attention, exemplified by ChatGPT’s rapid growth, amassing 100 million users in just two months. This surge is driven by the immense potential of Generative AI, projected to add up to $4.4 trillion to the global economy annually. However, major companies like Apple and Samsung have […]