Solutions

We provide market-tested fintech solutions based on accumulated know-how

mindox (Intelligent Document Processing)

mindox is an AI-powered document processing solution that addresses two main challenges: the lack of insights from data trapped in documents and the slow turnaround times caused by manual data entry.

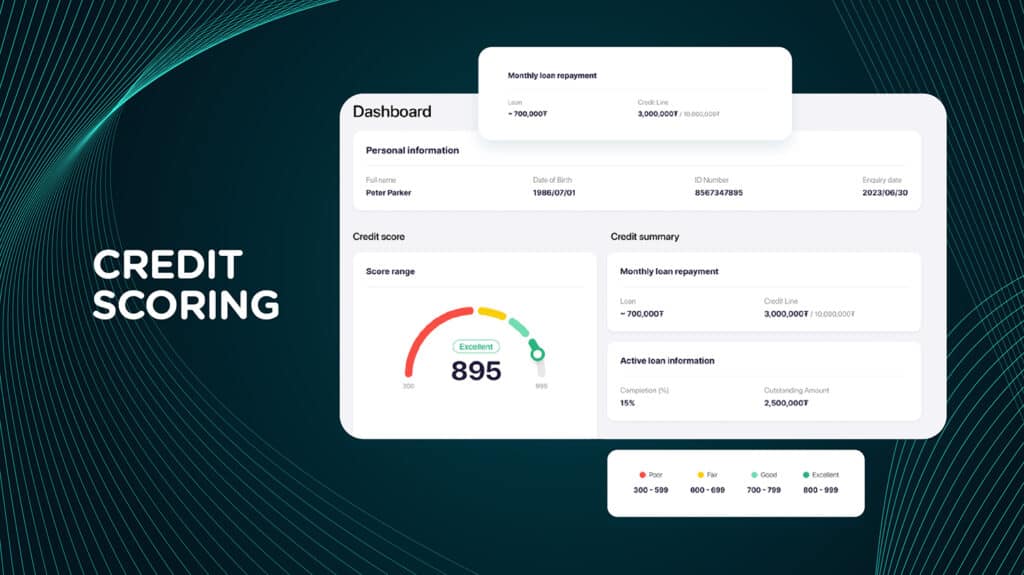

Credit Scoring System

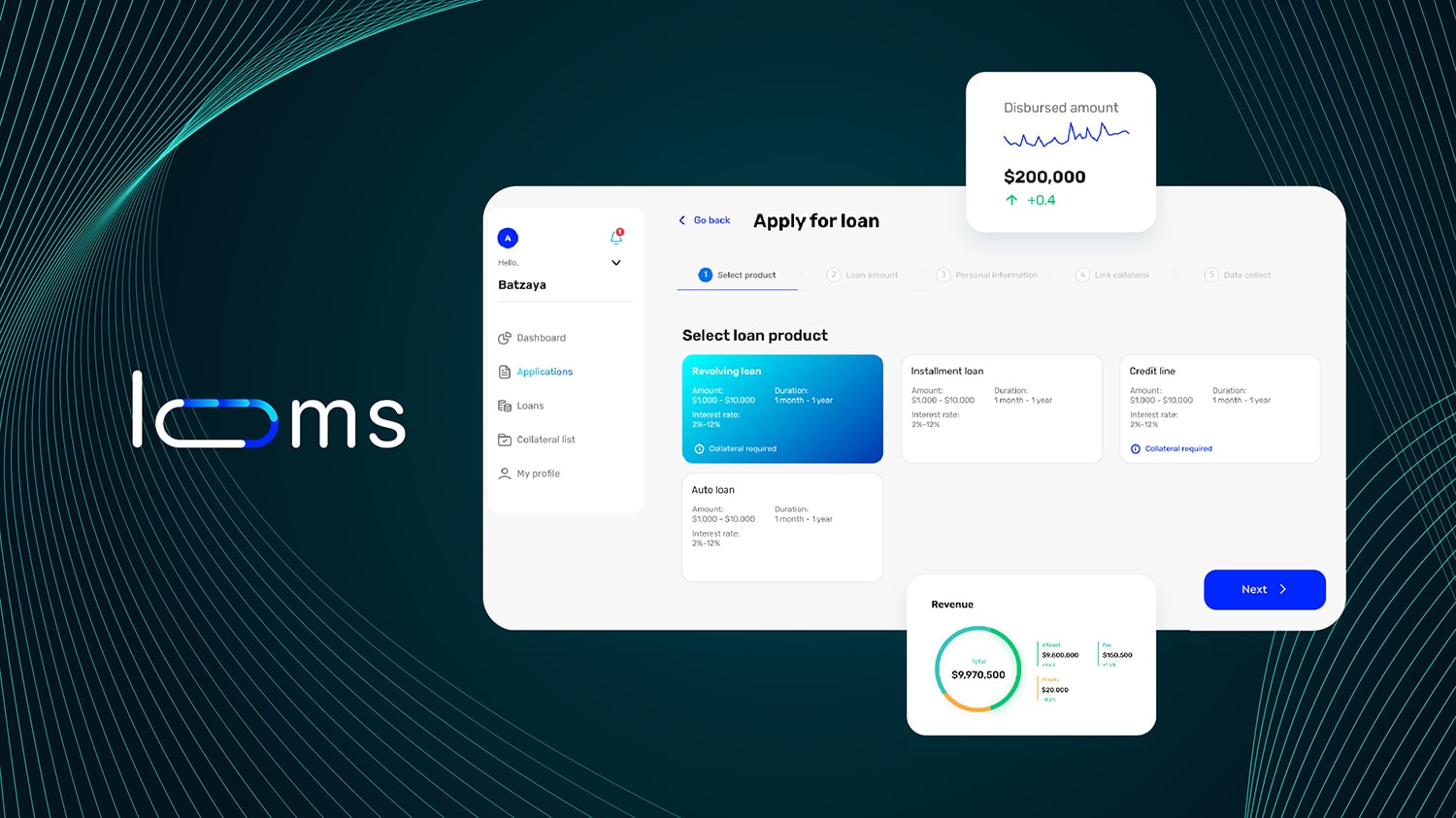

looms - LOS/LMS

Designed with your convenience in mind, looms streamlines the borrowing process, reduces operational cost while minimizing the credit risk.

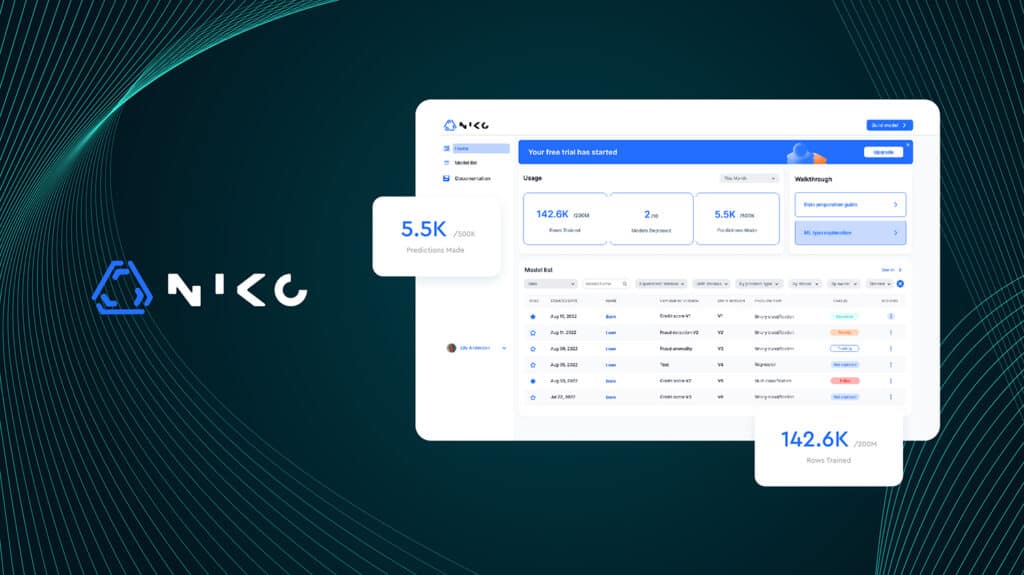

NIKO AutoML

NIKO is a no-code automated machine learning platform designed to make AI accessible for business decision-making. Accelerate your business growth through data-driven decision-making with NIKO’s end to end features.

Lending system for a commercial bank (Cambodia)

Credit scoring and lending system for a leading NBFI (Mongolia)

Lending and credit scoring system for the leading micro-lending fintech service provider covering over half the adult population of Mongolia

India, SME credit scoring service (In collaboration with SCV)

Enterprise scoring system for micro, small and medium enterprises in collaboration with the Standard Chartered Ventures.