Successfully Implementing IT Solutions: A Comprehensive Guide to SaaS and PaaS

This guide equips you with the knowledge and steps to successfully integrate Software as a Service (SaaS) and Platform as

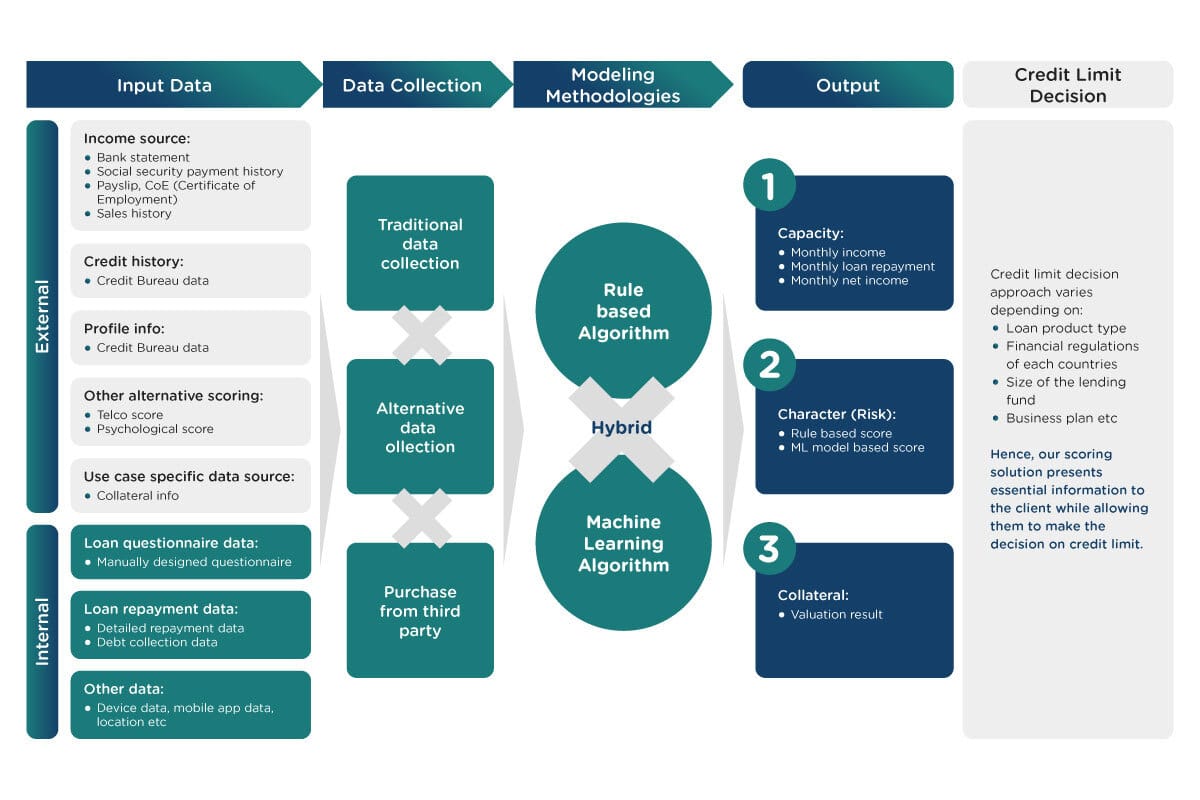

Transform your credit decision-making process with our AI-powered, custom Credit Scoring Solution. Designed to meet the complex needs of your business, our system utilizes your historical data to achieve higher APPROVAL RATES with REDUCED RISK, all within a shorter TURN AROUND TIME.

Our clients

We prioritize your business objectives in designing our credit scoring solutions. Our approach includes offering consulting services to clearly define your business goals, followed by crafting a tailored credit scoring solution that aligns with these objectives.

By integrating our credit scoring expertise with your extensive customer data, we are able to provide a credit scoring system that meticulously learns from every aspect of your unique customer information."

Leveraging the inherent adaptability of AI technology, we ensure your credit scoring solution remains current and effective in the dynamically changing business landscape.

In the intricate realm of financial services, adherence to compliance is essential. Our expertise in managing customer data and interpreting 'black box' AI model outcomes ensures that your credit decision-making process is both understandable and transparent.

Designed for businesses of all sizes, our credit scoring system seamlessly integrates into your existing infrastructure, enhancing efficiency without disrupting workflow, and scales with your business growth.

**AI/ML Credit Scoring Expertise:**

Our specialty in AI/ML-powered Custom Credit Scoring solutions is unmatched. We deliver precise, efficient, and seamlessly integrated systems to enhance your decision-making and operational efficiency.

**Data Science and MLOps Excellence:**

We excel in integrating advanced data science with

Machine Learning Operations, ensuring our solutions are innovative, practical, and scalable.

**Problem-Solving Approach:**

Our team is driven by a problem-solving ethos, focused on

understanding and effectively addressing your unique business challenges with tailored strategies.

**Partnership:**

At AND Solutions, we don't just sell a product; we offer a partnership in

revolutionizing your consumer lending strategy. From precision in risk assessment to real-time

decision-making, our solutions are designed to elevate your business to new heights. Choose us for a

trusted ally with a proven history, a commitment to customization, and a dedication to continuous

innovation in the dynamic world of AI/ML powered credit scoring.

Solution introduction, scoping and commercial discussions

Option 1

API service integration (monthly support and maintenance fee)

Option 2

Deploy to our AutoML platform

Option 2

Acquire your model IP (upon discussion)

Whether you’re looking to buy for parity or build for differentiation, our products empowers you to create unique experiences that truly set you apart from the competition.

Get to market faster with our proven Model Bank accelerators.

Take a holistic approach

with our all-in-one platform.

Deliver business value with

progressive modernization.

Let’s make it happen, together.

Your success is our shared mission.

Leverage our Adopt and Build

methodology to get results.

This guide equips you with the knowledge and steps to successfully integrate Software as a Service (SaaS) and Platform as

AND Solutions, a leader in AI-powered credit rating solutions, is proud to announce a groundbreaking development in Mongolia’s financial sector.

Just a few years ago, generative AI was a mere buzzword. Then came ChatGPT in 2022, and suddenly, this novel

Our Sales executives can help you find the right solution.